Oh, I’ve certainly had my share of years where I did overspend on Christmas.

Looking back, they were the years when I had no financial goals that were documented. I’m sure I had some goals floating around in my head.

Immediately on (and sometimes before) November 1st, we are bombarded with sales that can’t be beat and a count down to the biggest sales of the year.

I thought the term Black Friday was given because that’s when stores went from being in the red (non-profitable) to becoming in the black (profitable). However, Britannica tells me that a “more accurate explanation of the term dates back to the early 1960s, when police officers in Philadelphia began using the phrase “Black Friday” to describe the chaos that resulted when large numbers of suburban tourists came into the city to begin their holiday shopping”.

Shopping on this day, and the days surrounding Black Friday, is just what we do. The deals are truly deals and we are getting a bargain.

However, if it wasn’t something you were already going to buy, is it really a bargain?

Eh, regardless, we are going to take a deeper look into what you can do to not overspend on Christmas. Let’s begin.

Make Your List

You have got to have a list made. This is key number one for success.

Have a list that you can refer back to every year so you don’t have to create a new list and possibly forget someone.

In order to not overspend on Christmas, you must spend time on this list. Include everyone you’ve given to in the past and even those that you aren’t too sure about.

Don’t forget about the people that you give to like the mail person, your kid’s school crossing guards, teachers, co-workers, etc… I’m not telling you to add any of these people if you don’t normally give to them. I’m saying that the list needs to include all of the people you plan to spend on. Who you spend on is completely your decision.

If in doubt, put them on the list. You can always remove them later and use that extra money elsewhere.

Create a spreadsheet and map this out. Here’s an example of what your list will look like (we’ll talk about the budget next).

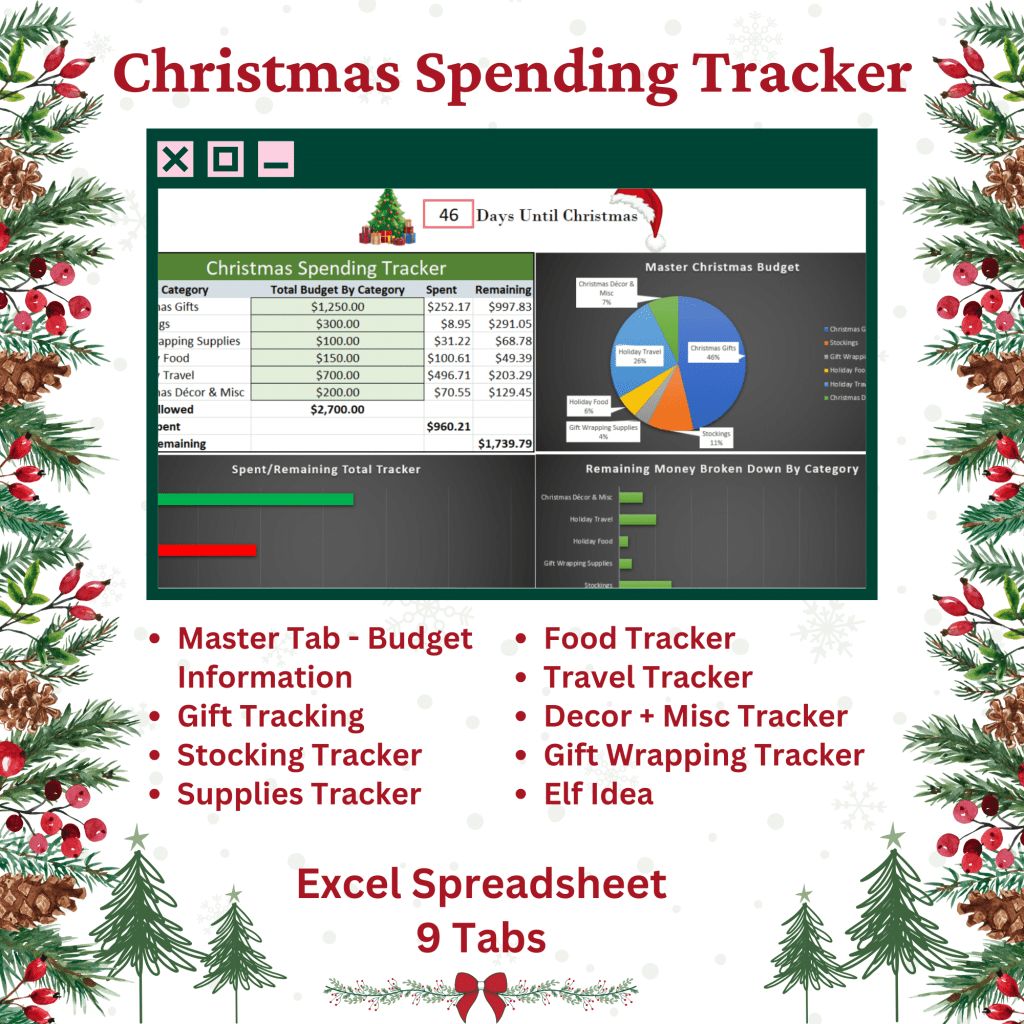

If you’re interested in a Christmas Spending Tracker, check out my all-in-one spreadsheet here.

Know Your Budget And Break It Down

Going into this blindly is a recipe for disaster.

Did you overspend on Christmas last year? Do you know what you spent last year?

Do you already have a set amount of money put aside?

If you’re able to see what you spent last year, that would be a great place to start if you do not already have money on the side.

Yes, you could start by going down the list of people and setting a budget to each name. We are going to do that anyway.

However, I would suggest having an overall dollar amount that you feel comfortable spending.

Next, go through each name and put a dollar amount next to the name.

Is your total close to your budget?

Setting an amount and sticking to it so that you do not overspend on Christmas will be much easier if you have created a spreadsheet like the one above.

Hopefully your budget is close to what you actually want to spend.

Not Everyone Wants Things

As I’ve grown older, I have realized that not everyone wants or needs things.

Got a friend with a new baby? Perhaps she wants a night out and the best present you could ever give would be your time. How much does a babysitter cost? You could easily be saving her $50.

Do you buy gifts for your parents? Maybe what they would love most, is you spending time with them for a weekend.

Seeing presents under the tree is what we expect. Yes, they are beautiful sitting there and fun unwrapping.

You can wrap offerings of a service or your time. Be creative.

One of the best presents I have ever received were from my kids when they were younger. The “chore coupon” book that they wrapped in an old shoe box was priceless.

Perhaps you make the best chicken pot pie ever. Your best friend would love it if you stopped by with enough to cover her family dinner to give her a night off.

The point is to think out of the box and don’t be tied down by what society is wanting you to believe is right.

On another note, perhaps your friend who is going through a rough time is feeling like they can’t afford to get you a gift this year, but you’ve always exchanged gifts. They are also searching for ways to not overspend on Christmas.

Wouldn’t it be fun if you had someone with the same mindset on this journey to not overspend on Christmas with you?

Talk with people. See what they want and be open to new ideas.

“Because It’s On Sale”

Doesn’t mean you need it.

If it wasn’t on your original list of items to buy, don’t buy it.

This is difficult because so many things are flashing in front of us that make us feel like this deal will never happen again. We have to get it now or we are going to be missing out.

I’ve regretted quite a few purchases in my life. I can’t remember one that I didn’t buy that I wish I had.

I take that back. There was this one purse I saw at a store that I wanted. I ended up not buying it and I did think about it afterwards. I could have bought it online and shipped it for free. But I didn’t. What happened next?

My kids bought it for me for Christmas that year without me even mentioning it.

If there’s something you just have to have, put it on your list for someone else to buy you.

To steer clear of temptation and not overspend on Christmas, unsubscribe to anyone that sends you “deal alerts” or “must have” items. It’ll be easier not to give in to temptation if the temptation was never there to begin with.

Stick To Your Budget

Now that your budget is created for every person on the list and you have some idea of the item you’re looking to purchase, start researching.

Look on Amazon and see what the current price for the item is. That’s now the maximum amount you’ll pay for that item.

I personally often use slickdeals.net when I’m waiting for something to go on sale. I can do a search on the item and see if it’s been on sale in the past and how cheap it went.

Basically, I’ve turned the excitement of buying a bunch of things into an excitement for buying the right things at the lowest price I can find.

It’s sort of a mental game I’m playing with myself. My excitement comes in the form of fulfilling my goal when I don’t overspend on Christmas and actually have budget dollars leftover.

I still want the excitement of buying during all these Christmas bargains, but I don’t want to walk away with double my budget being blown plus a lot of items I don’t need.

Final Thoughts On How To Not Overspend On Christmas

Make your game plan early so you have plenty of time to get everyone on the list and think about the individual gift (or gifts) for each person.

You can still go out with your friends Black Friday shopping and gasp in excitement as all the ads are released. The difference between then and now is that you have a plan that you are sticking to.

You may be tempted to buy a new tree or decorations as soon as they come out and we all get into the holiday spirit. Keep in mind that after Christmas discounts on holiday items are usually worth waiting for. If there’s anything you’re itching to purchase that may take away from your spending budget, consider purchasing after Christmas day.

For some extra cash, check out my articles on hobbies that could turn a profit, 50 items you could sell around your house and side hustles.

There’s also no shame in regifting. 🙂

0 Comments